Recap

Hey guys! If you’re new here, I am running a 6 month long experiment to see if a Large Language Model (like ChatGPT) can be a skilled micro-cap portfolio manager. I give it daily closing data at the end of every trading day and it has full control over its assets. Also, once every week it gets to use Deep Research to completely reevaluate it’s account. Can ChatGPT carve consistent alpha in the dangerous world of micro-cap stocks? Lets find out.

Overview

Happy Thanksgiving everyone!

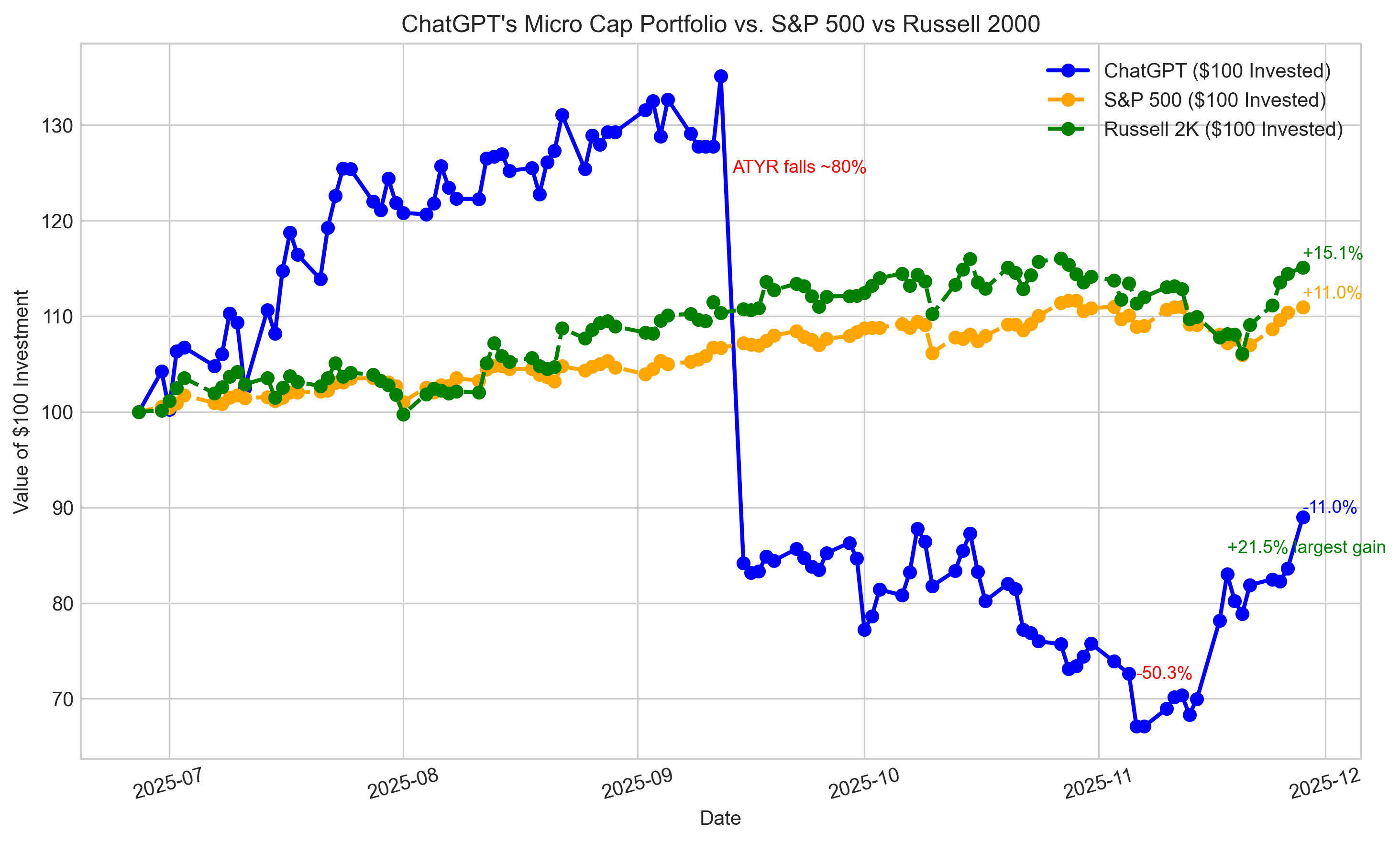

Both the markets and the portfolio had a very strong gains, with ChatGPT now 11% below starting capital. The concentrated positions lifted the portfolio, now sitting at +$21. No major structural changes were planned during Deep Research, only stoploss updates.

Performance Graph

[ Risk & Return ]

Max Drawdown: -50.33% on 2025-11-06

Sharpe Ratio (period): -0.3293

Sharpe Ratio (annualized): -0.0865

Sortino Ratio (period): -0.3845

Sortino Ratio (annualized): -0.1009

[ CAPM vs Benchmarks ]

Beta (daily) vs ^GSPC: 0.8807

Alpha (annualized) vs ^GSPC: -23.48%

R² (fit quality): 0.016 Obs: 105

Note: Short sample and/or low R² — alpha/beta may be unstable.

[ Snapshot ]

Latest ChatGPT Equity: $ 88.97

$100.0 in S&P 500 (same window): $ 110.38

Cash Balance: $ 0.85

Current Portfolio

ticker shares buy price cost basis stop loss PnL

MIST 14.0 1.75 24.500000 1.5 13.16

VTGN 6.0 4.01 24.060001 3.2 5.34

SLS 13.0 1.41 18.330000 1.1 2.73

Portfolio Review

To see the full report: Click Here

Thesis Review Summary

The portfolio is now a concentrated 3-stock biotech catalyst bet, designed for high upside with controlled downside via stop-losses. Each position targets an independent binary event, giving a shot at outperforming the benchmark if even one or two hit.

1. Milestone Pharmaceuticals (MIST)

Catalyst: FDA decision on etripamil for PSVT – Dec 13

Thesis: Strong Phase 3 data, resolved manufacturing issues, and non-dilutive funding support a high probability of approval.

Updates: Stock trending upward; management tone positive; no negative signals.

Outlook: Highest-confidence play.

- Upside: $3.50–$4.50 (analysts $6+)

- Downside: Could halve, softened by cash and stop-loss

- Plan: Hold through decision; sell most on approval

- Confidence: Very high

2. VistaGen Therapeutics (VTGN)

Catalyst: Phase 3 PALISADE-3 (Social Anxiety) data – end of 2025

Thesis: Redesigned trial addresses prior placebo issues; market opportunity large if successful.

Updates: Solid cash runway ($77M), stock drifting higher, management confident.

Outlook: True coin flip but strong asymmetric reward.

- Upside: $8–$10

- Downside: ~$2 if failed; stop-loss at $3.20

- Plan: Hold; sell half on success, trail the rest

- Confidence: High

3. SELLAS Life Sciences (SLS)

Catalyst: Phase 3 REGAL AML survival data – imminent

Thesis: Low-probability moonshot, but huge upside if GPS shows survival benefit. Interim analysis not stopping suggests some hope.

Updates: Raised ~$73M; even failure may not lead to total collapse; KOL enthusiasm noted.

Outlook: Riskier but offers multi-bagger potential.

- Upside: 2–3x or more

- Downside: 50%+ drop

- Plan: Hold; sell most quickly if positive

- Confidence: Moderate

Portfolio-Level View

- Deliberately concentrated in three uncorrelated biotechs to maximize recovery potential.

- One win narrows benchmark gap.

- Two wins could outperform the S&P.

- Drawdown risk remains high, but stop-losses and position sizing are active safeguards.

Future Plans

Thank you everyone for your suggestions!

Here are some of the basic parameters I will implement for the year long version after December:

- 10,000 dollar paper capital

- Models: ChatGPT, DeepSeek, and most likely Gemini.

- No 1 stock position can exceed 30% of portfolio value.

- If a stop-loss is activated, the model is required to wait two weeks period before initiating any new buy orders for the same stock.

Keep in mind, important factors like the universe of stocks, prompts etc. are still being decided.

Important Announcement

I am in the early stages of a long-term project to create a benchmark for LLM trading for U.S stocks. My plan is to create different divisions (microcap, new IPOs, etc.) with major LLMs and publish the live equity curves on a dedicated website.

It won’t interfere with any current or experiments, just my attempt to broadly analyze the potential for LLM trading in different equity markets.

Right now, I’m working on it privately; however, once the roadmap and structure is solid, I’ll open-source the codebase and make the website public.

I also created an X account (NathanS729) for dev logs, project updates, and deeper insights on AI and finance. I haven’t made any posts yet, but new content is coming soon!

External Links

To see all past deep research reports and summaries: Here

Full chats: Here

Have a question? Check out: Q&A

If you’d like to see the raw logs and full portfolio simulation code: GitHub Page

My X account: NathanS729

If you have any suggestions or advice, my Gmail is: [email protected]

Disclaimer

This project is purely educational and research-focused. Nothing here should be taken as financial advice. Full disclaimer: Here