Recap

Hey guys! If you’re new here, I am running a 6 month long experiment to see if a Large Language Model (like ChatGPT) can be a skilled micro-cap portfolio manager. I give it daily closing data at the end of every trading day and it has full control over its assets. Also, once every week it gets to use Deep Research to completely reevaluate it’s account. Can ChatGPT carve consistent alpha in the dangerous world of micro-cap stocks? Lets find out.

Overview

Despite a heavy drawdown on Monday, the portfolio recovered to just under 30 percent overall. The performance was mainly driven by ATYR, which now represents about 30 percent of total capital. AXGN gained 9 percent on the 26th, softening the hit from ATYR. IINN continued its downward trend, and ABEO fell 5.66 percent over the past five days.

Current Portfolio

ticker shares buy price cost basis stop loss

ABEO 4.0 5.77 23.08 6.0

ATYR 8.0 5.09 40.72 4.2

IINN 10.0 1.25 12.50 1.0

AXGN 2.0 14.96 29.92 12.0

Cash: $15.08

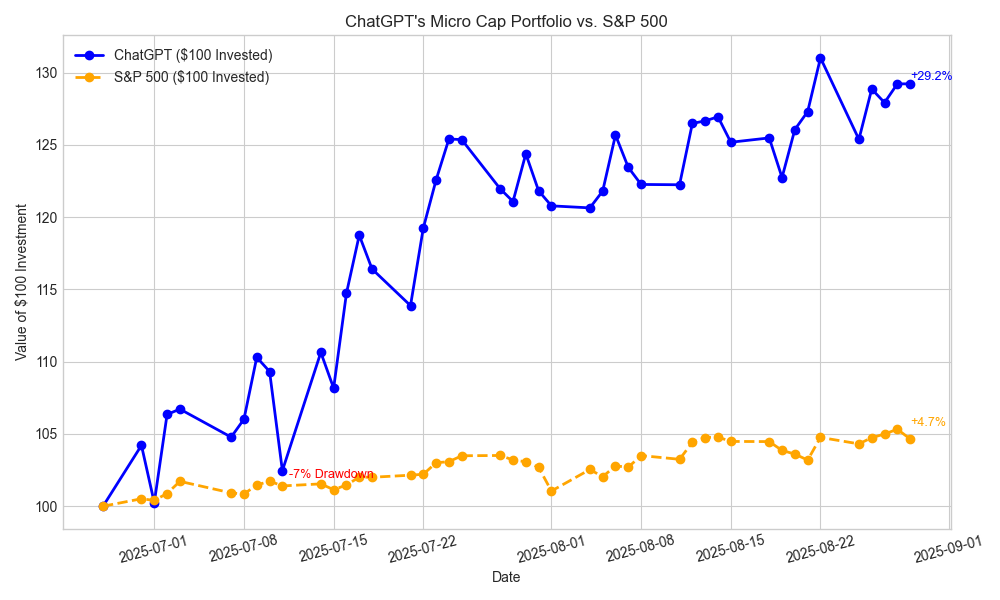

Performance Graph

Metrics:

[ Risk & Return ]

Max Drawdown: -7.11% on 2025-07-11

Sharpe Ratio (period): 1.2096

Sharpe Ratio (annualized): 2.8468

Sortino Ratio (period): 2.1630

Sortino Ratio (annualized): 5.0906

[ CAPM vs Benchmarks ]

Beta (daily) vs ^GSPC: 2.0582

Alpha (annualized) vs ^GSPC: 150.40%

R² (fit quality): 0.173 Obs: 43

Note: Short sample and/or low R² — alpha/beta may be unstable.

[ Snapshot ]

Latest ChatGPT Equity: $ 129.22

$100.0 in S&P 500 (same window): $ 104.11

Cash Balance: $ 15.08

Portfolio Review

To see the full report: Click Here

Updated Portfolio Thesis Summary (Post-Trade)

Keep / No Change

ABEO— hold 4 shares; stop $6.00. Thesis intact: gene therapy launch progressing; company well-capitalized. Already in profit; waiting for commercialization milestones.AXGN— hold 2 shares; stop raised to $13.00 (from $12.00). Despite FDA delay, fundamentals (revenue growth, approaching profitability) support holding through Dec 5 PDUFA; tighter stop manages risk during the wait.

Add to Existing Position

ATYR— buy +3 (to 11 total); stop $4.20. High conviction in efzofitimod Phase 3 potential; now the largest holding (~$59). Positive setup (completed enrollment, strong scientific rationale, limited competition). Size remains modest and acknowledges gap risk.

Exit / Trim Positions

IINN— sell 10 (exit). Catalyst ($22.5M order) realized; momentum faded; dilution risk. Redeploy ~$11 to higher-impact ideas (ATYR, FBIO).

Initiate New Position

FBIO— buy 4 @ $2.58; stop $2.00. Near-term catalyst: Sept 30 FDA decision on CUTX-101 (potential PRV worth ~$100M+), which could drive a re-rating. Diversified assets cushion downside vs. single-asset risk. ($10, ~7–8% of portfolio); liquidity adequate (avg volume >300K).

Notes

- No other new positions added.

OKYOandGENKwere considered but not added due to timing and cash constraints.

My Thoughts

FBIO has shown strong momentum with a 61 percent gain over the past six months and appears to be a solid option for diversification. Cutting IINN was the right move, as it continues to burn about 10 million dollars annually and the market shows no confidence even with a potential 22.5 million dollar deal. Doubling down on ATYR looks extremely risky; having a pure binary catalyst at 30 percent of the portfolio is already oversized, and increasing exposure further could create major downside risk, even if deep research reports have always remained bullish.

This project is purely educational and research-focused. Nothing here should be taken as financial advice. Full disclaimer: Here

GitHub Page and Email:

To see past deep research reports and summaries: Click Here

Have a question? Check out: Q&A

If you’re curious about the code, prompts, graphing, etc. the GitHub page is: ChatGPT-Micro-Cap-Experiment.

If you have any suggestions or advice, Gmail is : [email protected]